What must we do? Business in Canada's future

Que devons-nous faire ? Les entreprises dans l'avenir du Canada

Image from/du Canadian Anti-Monopoly Project

Addition on March 16, 2025:

We are adding to this “What must we do?” post as well as to that called “Building a country” this opinion piece in the Toronto Star by Angella MacEwen. It argues that investing in badly needed infrastructure, rather than dropping trade barriers, is key to making Canada more resilient.

Opinion | Canada’s response to Trump’s tariffs has been short-sighted. This is what we need to do instead

March 14, 2025

Investing in badly needed infrastructure, rather than dropping trade barriers, is key to making Canada more resilient, argues economist Angella MacEwen.

By Angella MacEwen, Contributor

Angella MacEwen is the senior economist for CUPE, and a policy fellow with the Broadbent Institute.

Canada has an opportunity to counter the economic crisis presented by Donald Trump’s tariffs and come out the other side stronger and more resilient. What we need is a bold nation building project centred on strategic public investment that connects us from coast-to-coast-to-coast.

Over three decades of free trade with the United States has made our economy heavily reliant on our next-door neighbour both as a source of business investment within Canada, and as a destination for our exports. Donald Trump’s tariffs threaten both of these, possibly altering our economy permanently.

None of the short-term solutions being floated are up to the challenge of the moment. The economic benefit of eliminating interprovincial trade barriers has been overstated. In some cases removing so-called barriers could even be counterproductive to fostering a healthy, independent economy. For example, some of the federal government’s changes to the interprovincial trade deal could limit their ability to invest in and regulate much needed East-West infrastructure.

In the mean time, employment insurance is necessary to help affected workers weather the crisis. But it doesn’t build new industries or save the ones that could disappear if we don’t take action.

We need something bigger, bolder, and very different from what we’ve been used to . We need the public sector to invest directly in the infrastructure and key assets needed to support the economy.

First, we need an industrial strategy that engages the imaginations of Canadians and protects the Canadian social and economic model. That model is one in which governments support domestic industries through public research, strategic procurement policies, and critical investment in infrastructure.

Rather than simply dropping trade barriers, building publicly owned and low-cost transportation, communications, and energy infrastructure between provinces and territories recognizes the biggest barrier to interprovincial trade is our vast geography.

We need to consider public ownership to support investment in key sectors such as agriculture, resource extraction, pharmaceutical production, and auto manufacturing, so we can drive investment. Canada should also ensure domestic control over strategic assets where the exit of US investment has left gaps in the supply chain within these key sectors, such as midstream refining capacity.

A bold Canadian program would also embrace Canada’s rich diversity and embrace reconciliation through Indigenous Peoples’ right to meaningful engagement over policies that impact their land, territories, languages, cultures and way of life — something we haven’t done in previous nation-building exercises.

Instead, the federal government response so far has been on incentivizing market actors, for example through eliminating so-called interprovincial barriers to trade. On Feb. 21, the federal government announced that they were removing 20 exceptions from the Canadian Free Trade Agreement (CFTA). This approach is short-sighted and counterproductive.

One of the existing policy measures removed was related to limiting foreign ownership and control of facilities-based telecommunications service providers, such as Telus, Bell, Rogers, and Videotron. It strains the imagination how this measure could have presented any kind of barrier to interprovincial trade, and there is no logic to removing protections for a key domestic industry just as Canada needs to be thinking about building and supporting national infrastructure.

The federal government also removed Canada Post’s right to have a monopoly on delivering letter mail from the CFTA. Canada Post has an established delivery network throughout Canada, delivering mail and goods to parts of Canada untouched by private delivery services. We should be looking to take advantage of Canada Post’s logistics infrastructure, instead of further undermining it.

Future policy measures also on the chopping block included the federal government’s ability to direct infrastructure investments based on national and regional needs, their ability to approve transportation and transmission on pipelines and power lines, and their ability to advance a general framework of regional economic development — exactly at the moment that the most effective counter-tariff strategy would be to do exactly those things.

Rather than these piecemeal measures that may end up doing as much harm as good, Canada instead needs to think bigger and reimagine the role of the public sector in shaping our economy. Big public investments strategically directed toward our broader long-term interests have shaped Canada in the past, and are exactly what we need to foster an independent and vibrant economy today.

Common introduction to each post in the “CANADA’S FUTURE,” “What must we do?” series of posts

On March 8, the Pledge emailed via Substack its first newsletter (called “Canada’s Future”) to the full list of supporters of the Pledge who also opted in to email updates (70,000 of you in total, at present). That newsletter is simultaneously a “post” (or, “article”) also called “Canada’s Future,” located on this Pledge website on Substack.

The “Canada’s Future” newsletter-article set out some observations and arguments about this historical moment in which we find ourselves and then asks Pledge supporters to engage on the Pledge’s Substack platform about what we must do to secure our future, to secure a Canada we want:

Make no mistake, Canadians will build a better Canada. There’s no shortage of ideas. What’s needed is a grand and diverse coalition of Canadians ready to do their part and to push their governments to work together and rise to the challenge.

We are including for your consideration several articles that try to sketch out an agenda for a less dependent, more resilient and just Canada. There is some overlap, some disagreement, some gaps [amongst theme].

Clicking on any given link [found in the “Canada’s Future” article] takes you to a post on the Pledge’s website…. From there, you can link to further information. The purpose is to launch a conversation amongst Pledge supporters.

You can comment/reply to posts by clicking on an icon that resembles a cartoon speech bubble at both the top and bottom of the post. You may choose to comment, and thereby participate in online dialogue, on any or all of the linked posts below.

This is one of seven posts that connect back to the “Canada’s Future” newsletter/article.

Please consider participating!

Business in Canada’s future: an invitation to discuss this post’s themes with other Pledge supporters

In this post, we concentrate on “business” in the context of two sets of proposed polices of strengthening and protecting Canada’s businesses and business capacity in a with-Trump world. Down the road, we are likely to have other economy-focused posts, for example on productivity, the place of public enterprises, alternative trade axes, and so on.

The first set are found in a blog article by Matthew Mendelsohn and Jon Shell of Social Capital Partners published a few days ago on March 5. It is called “Four ways to keep Canadian businesses in Canadian hands.” The second set of policy proposals were just released by the Canadian Anti-Monopoly Project (CAMP) in an 11-page document called “A Canadian Anti-Monopoly Agenda.”

You can link to each to read the first piece in the original form and to read the entirety of the second piece, but we are reproducing below the entire first piece and the graphics showing the proposals from the second piece in order to make reference easier as Pledge supporters discuss the ideas.

Each piece is not just focused on strengthening Canadian businesses in the context of the Trump regime’s agenda and of a growing consensus in Canada that wrestling ourselves from over overdependence on the US is essential to our future. But each also is responsive to dangers to Canada’s economic sovereignty that are already baked into the economic landscape of North America and could well worsen with a more aggressive American reality.

The Mendelsohn and Shell piece uses as a point of reference the likelihood of American corporations (hedge funds, etc) searching north of the border for Canadian businesses to acquire in the distressed environment Trump is trying to create. The CAMP proposals are made against the backdrop of economic and political forces that have been empowering oligarchy and near-monopolies — especially in the tech world — that have multiple ways to engage in anti-competitive behaviour or benefit from unfair competition.

Is the each set of proposals a whole package that is both necessary and feasible?

Are some proposals – whether immediate-term or longer-term – most important and need prioritization come what may?

Again, as explained in the “Canada’s Future” post, clicking on the speech bubble icon at the top and bottom of the post is how you can make a comment. You can then reply to others’ comments. Please try to abide by two principles as expressed in Substack’s community guidelines for publications like the Pledge. They are expressed as applying to “writers” but the Pledge extends that notion to everyone commenting in threads on Pledge articles/posts.

1. Be kind to each other. Substack is founded on the belief that writers and their work deserve respect. Keep conversations civil in the comments of this publication and other Substack community spaces, such as events. Respect one other’s perspectives and life experiences in your conversations, and refrain from cruel or derogatory language.

2. Stay on-topic. We want this publication to support thoughtful discussion around writers’ work. It is not a place for irrelevant rants or off-topic digressions. That includes spam and repetitive self-promotion.

PIECE #1:

Four ways to keep Canadian businesses in Canadian hands

March 5, 2025| Blog, Special Series

By Matthew Mendelsohn and Jon Shell | Part of our Special Series: Always Canada. Never 51 (Note from the Pledge: Go here to see nine other sets of proposals responding to the “Never 51” imperative.)

The nature of the threat that Trump represents is becoming clearer. One aspect that requires urgent action is the risk that Canadians could lose even more control over our own economy and become even more vulnerable in the coming months. Although Canadians want to become less dependent on the U.S., there are forces at play that are pushing in the opposite direction.

Given a low Canadian dollar and likely lower interest rates, there is no doubt there will be many American investors looking to come and buy up more of our businesses and other assets. This could further rob Canadians of our economic sovereignty.

Canada has historically sought out Foreign Direct Investment (FDI). The Canadian government regularly touts increased investment flows into Canada as a positive sign for our economy. But it is important to differentiate between investment that builds up our economy and investment that sells our assets, industrial capacity and intellectual property to foreign investors and leaves us weaker. The latter extracts wealth and weakens Canada over the long term.

Canada is also in the midst of the Silver Tsunami – a wave of retiring business owners looking to sell their businesses and secure their retirement. Canadian business owners of course should have retirement security, but many of these entrepreneurs would love to keep their businesses in local Canadian hands.

So, some kinds of FDI are bad, and some mergers and acquisitions have negative national security implications. Even before Trump took office, these combined trends demanded an urgent and serious response. Today, they are a high-level threat to our economic security. We need to change fast.

Many American investors and firms are looking to buy up Canadian assets at the moment. And the overt policy of the U.S. government is to use economic pressure to threaten Canadian sovereignty and put Canadian businesses in a position where they will need to sell. Many businesses will face liquidity issues and will see the value of their assets decline and American finance will sniff out these opportunities.

Despite the fact that Canadian governments, business leaders, workers and Canadians from across the country all say they want to be less economically vulnerable, there is a real chance that two years from now even more of the Canadian economy and our assets will be owned by American investors who don’t care at all about the health of our economy or communities.

Here are four ideas on how to keep ownership of Canadian assets in Canadian hands. Every detail has not been worked out, but these ideas are actionable and could prevent American finance from gobbling up more of the Canadian economy. We hope policymakers can build out these ideas and develop more of them – I am sure there are others!

1. Make it easier for new Canadian entrepreneurs to buy existing Canadian businesses from owners who want to retire.

We are facing a wave of business retirements and Canada needs more entrepreneurs. The Canadian government can do more to facilitate ‘entrepreneurship through acquisition’ – that is, helping new entrepreneurs buy existing businesses.

Canada needs more entrepreneurs who want to build, rebuild and grow businesses that contribute value to their communities. The last couple of decades have seen a change in the kind of entrepreneurship that is prioritized, with many entrepreneurs focusing on ‘exit’ – that is, building a business with the goal of selling it to a larger financial player. Today, we need to help young entrepreneurs buy businesses that they want to run for the long haul.

The federal government should significantly de-risk purchases of existing businesses by new Canadian independent entrepreneurs. This could be done through amendments to the Small Business Financing Program, directing the Business Development Bank of Canada (BDC) to prioritize this type of transaction or the launch of a significant new loan guarantee program aimed specifically at entrepreneurship through acquisition.

2. Invest patient capital into Canadian manufacturers and other vulnerable sectors through a new, independently managed sovereign buy-out fund.

Some manufacturers are about to feel pain from U.S. tariffs. Some will be at risk of closing or will feel pressure to relocate or sell to foreign investors. In order to diversify their exports away from the U.S., they will need to re-tool and make new investments. Some won’t be able to do that. We need a policy response to ensure they remain liquid, sovereign and have the capital to withstand the current crisis and re-tool for domestic needs and global markets.

The federal government should work with our large pension funds and invest together in a new fund that would buy or invest in existing manufacturing firms that run into trouble. The federal government should guarantee a benchmark rate of return for the pension funds, so that Canadian pension dollars are protected. The fund should be run independently by those with experience in manufacturing, finance and private equity with the goal of building an advanced and resilient manufacturing sector necessary for a more prosperous, independent Canada. Such a project will require permanent, patient capital—capital managed for long-term value creation instead of short-term gains.

3. Make it easier for business owners to sell to their employees.

Employee Ownership Trusts (EOTs) were created in Canada last year as a vehicle for business owners to more easily sell their businesses to their employees. This has the potential to unleash a wave of business transitions and thousands of new worker-owners, as it has in the U.K. But obstacles remain and workers often compete with those seeking to buy up Canadian assets.

The government should clarify the rules around EOTs, some of which are creating uncertainty amongst lawyers, accountants, advisors and business owners. Many entrepreneurs want to sell to their employees, but uncertainty around who is eligible and whether tax exemptions will expire are inhibiting transactions. There are easy fixes for these snags, and we must not delay: the federal government should clarify the rules as soon as possible so that businesses can be sold to their employees. Canadian pension funds should also invest in a fund to facilitate employee-ownership transitions, with the federal government guaranteeing a benchmark rate of return.

4. Do not allow American purchases of Canadian businesses.

Foreign purchases of Canadian firms are reviewed under the Investment Canada Act under certain circumstances and are sometimes subjected to a national security screen. Small acquisitions are not reviewed, which is appropriate in normal times, but now represents a threat to Canadian economic sovereignty.

The current legislation allows large foreign investors to serially acquire smaller firms and, over time, consolidate industries in foreign hands. The risk of this is now even greater, as many Canadian business owners might be anxious to sell and foreign investors currently have exchange-rate advantages.

Changes to the Investment Canada Act were passed in 2024, but we need immediate new targeted changes to respond to the current environment. Those should include an ability to review smaller transactions and an emergency power that can be invoked by the government to put on hold all foreign acquisitions for a period of time. In conjunction with the earlier options, it would be possible for Canadian funds to step in and acquire businesses instead, with the federal government offering some kinds of guarantees.

These are some ideas that should be investigated. They all have a reasonable chance of enhancing economic resilience, creating wealth-building opportunities for Canadian workers and entrepreneurs and increasing Canadian economic sovereignty. We are sure there are others. Let’s get to work on them yesterday.

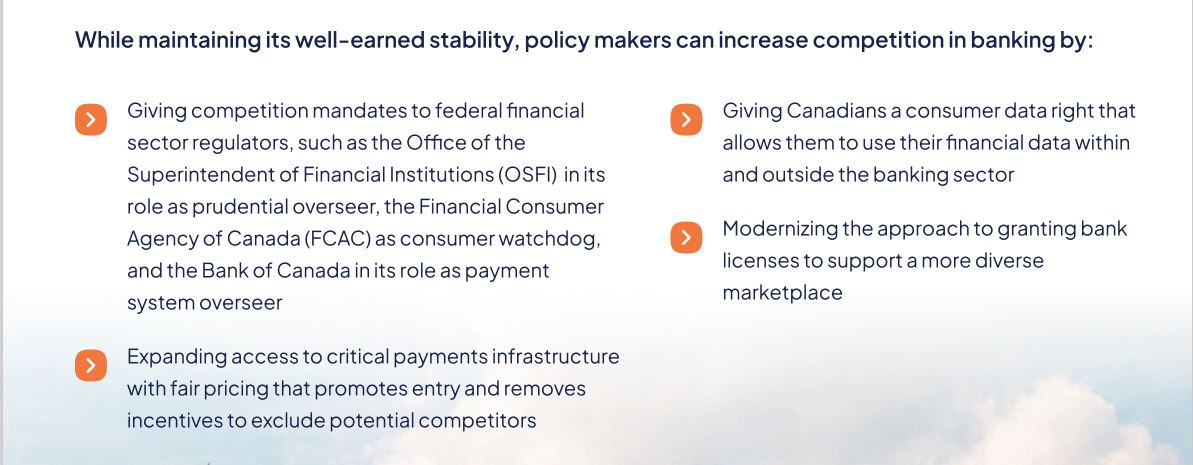

PIECE #2: A Canadian Anti-Monopoly Agenda

The CAMP project introduces their 11-page document with the following:

Canadians find ourselves at a critical juncture in our history. While inflation is slowing, the cost-of-living crisis it brought on continues to weigh heavily on Canadians who no longer feel they are getting a fair deal in their own country. On the heels of this economic strain, the country’s economic model is entering a period of unprecedented uncertainty as the relationship with our closest neighbour and ally fundamentally changes for the worse.

In the face of this uncertainty, Canada must chart an economic course that fosters greater resilience and independence at home. An anti-monopoly approach, skeptical of dependence and emphasizing diversity and resilience, is a key component to building this kind of economy.

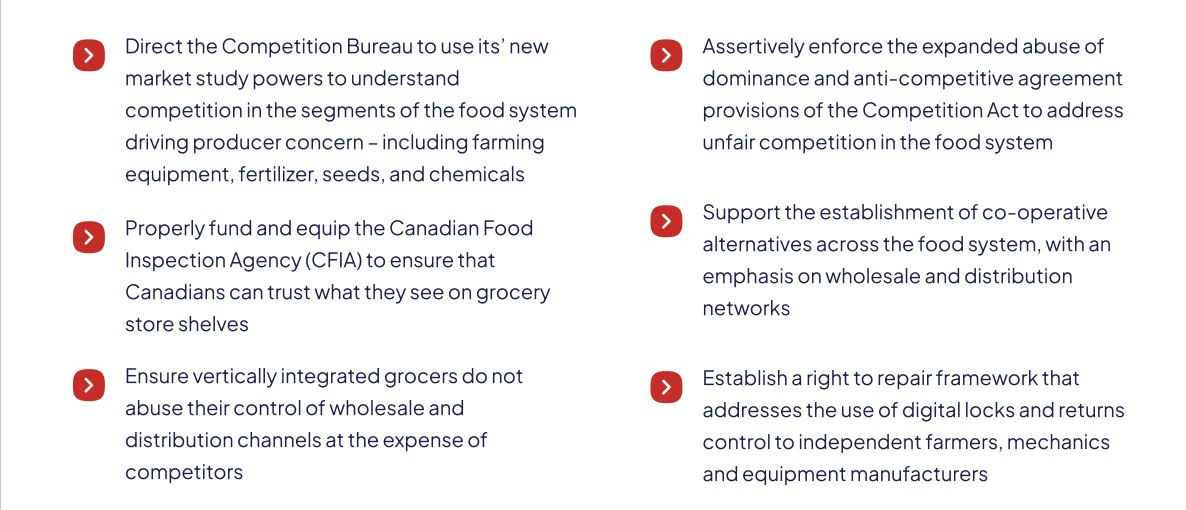

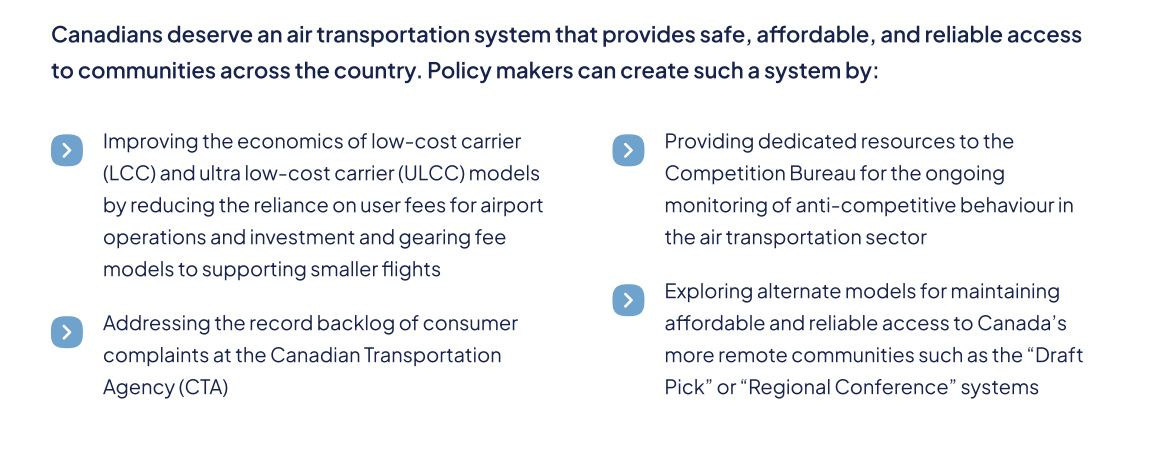

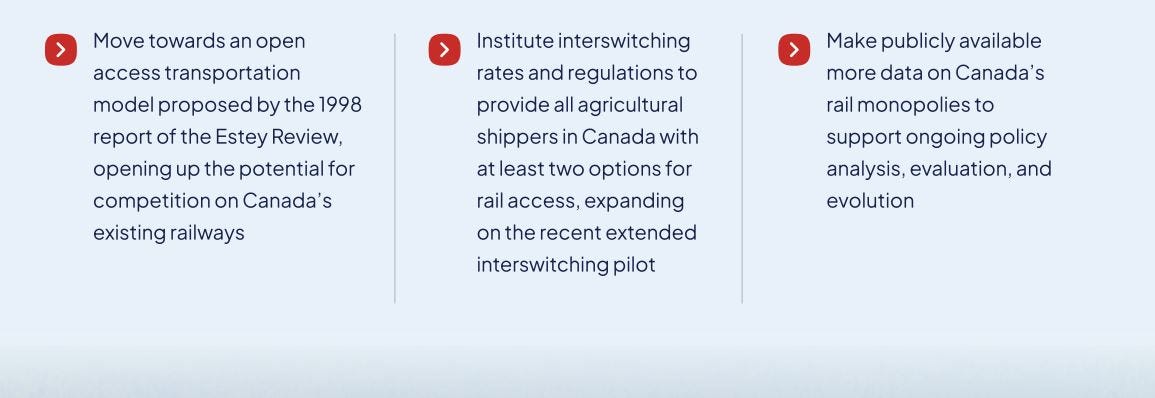

Pulling together ideas from a diverse range of policy areas; CAMP is proud to release its Canadian Anti-Monopoly Agenda, a series of policy solutions to support Canada’s effort to reinforce our economy amid growing global uncertainty. Across key areas of our economy – food, housing, transportation, communication, digital markets, and banking – policy makers at all levels of government have an opportunity to chart an anti- monopoly future for Canada’s economy.

Below we reproduce screenshots of their proposals organized around seven themes:

~~~~

Chaque article est rédigé en anglais uniquement.

We are adding to this two “What must we do?” posts -- Business in Canada's Future andBuilding a Country -- an opinion piece in the Toronto Star by Angella MacEwen called "Canada’s response to Trump’s tariffs has been short-sighted. This is what we need to do instead." It argues that investing in badly needed infrastructure, rather than dropping trade barriers, is key to making Canada more resilient. You can read the entire piece at the top of each of the "What must we do?" posts.

I found the article by Matthew Mendelsohn and Jon Shell very informative. I wasn't aware of these dangerous business buyouts or transactions that have been going on in Canada. I hope you have solid professionals in government ministries, and business looking at your solutions.